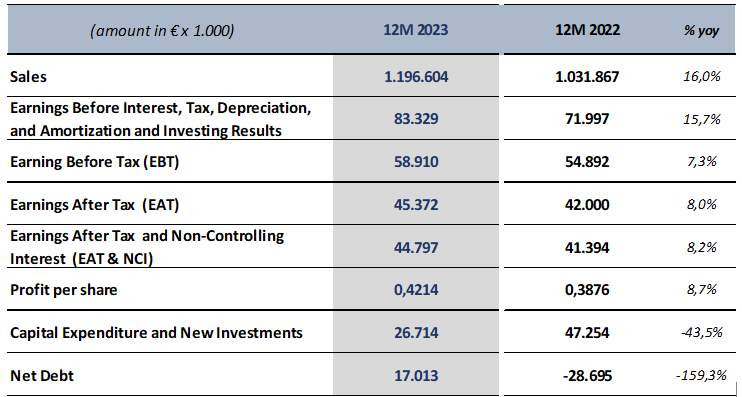

During Full Year 2023, on a consolidated basis, Quest Group recorded Sales €1,2 billion, EBITDA €83,3m, EBT €58,9m and EAT €45,4m.

Compared to last year, Quest Group Sales grew by 16%, EBITDA by 15,7%, while EBT and EAT augmented by 7,3% and 8% respectively. It is worth noting that 2022 benefited by €1,3m capital gains from the sale of minority stakes and by €1,2m, from the reversal of previous years’ provisions. Excluding these extraordinary earnings, 2023 EΒT is improved by roughly 12,5% compared to last year. The lower (compared to Sales & EBITDA) increase in EBT is mainly due to the increase of the net financing cost by roughly €5,4 m. in 2023 due to the higher Euribor.

The key consolidated financial results & figures are illustrated as follows:

* Do not include “other gain/losses” related to investment activity.

Group’s Net Debt (Debt - Cash and Cash Equivalents) was €17m, compared to Net Cash of €28,7m on 31/12/2022. The change from the end of 2022 is mainly due to working capital needs, dividends distributed (equal to €21,3m) and new investments of about 27m..

FY2023 Results per segment:

- Commercial Activity (Info Quest Technologies, Quest on Line, iSquare, iStorm, Clima Quest,G.E.Dimitriou (GED), FoQus, Epafos).

Sales grew by a double digit (+16,9%), followed by an EBT increase of 2,9% on a YoY basis, due to higher financial costs driven by the significantly higher interest rates. It is worth noting that the segment’s EBITDA increased by 28%, mainly due to the contribution of GED.

- IT Services (Uni Systems, Intelli Solutions, Team Candi).

Sales augmented at a double-digit pace (+21,8%), and EBT by 25,6%. Demand for IT services continues to be strong, due to the high number of digital transformation projects of the private and public sector. Roughly 50% of sales are related to international activities.

- Postal Services (ACS Courier).

Sales increased by 5,6%, followed by a single digit EBT expansion (+4,3%). The growth is driven by the expansion of e-commerce. 2023 results were adversely impacted by extraordinary costs related mainly to the floods in Central Greece during September.

- Renewable Energy Production (Quest Energy).

During 2023, Sales were lower by -2,1% due to bad weather conditions (reduced sunshine), while EBT decreased by -1,7%.

Quest Holdings (parent company).

Parent company revenues during FY2023 reached €12,6m compared to €15,8m last year including €10,8m dividends from the subsidiaries. EBT were €10,7m compared to €13,4m during the same period of 2022.

2024 Outlook

The following outlook is estimated per segment:

Commercial Activities: We estimate a mild growth in sales compared to 2023. EBT is expected to be at the same levels as last year or marginally lower, primarily due to the significant increase of financial expenses (caused by Euribor’s rise) and secondarily by higher depreciation.

IT Services: Growth both in sales and profitability is estimated vs 2023, driven by a high demand for IT services in Greece and international markets. The company’s backlog (contracted projects to be executed) exceeds €550m.

Postal Services: We estimate higher growth in sales and profitability compared to 2023, driven by e-commerce expansion.

Renewable Energy Production: We estimate growth in sales and profitability driven by new investments, based on the hypothesis of normal weather conditions.

On aggregate for 2024, we estimate mild growth in Sales, EBITDA and EBT. It must also be noted that the Group has a solid commercial and financial position to successfully address any challenges that might arise, having more than €300m in cash and available credit lines.

Quest Group’s management will host a conference call to present and discuss the Full Year 2023 Financial Results, on Thursday 4th of April 2023, at 15:30 Athens time.

- GR participants dial in: + 30 213 009 6000 or + 30 210 946 0800

- UK participants dial in: + 44 203 059 5872

- US Participants dial in: +1 516 447 5632

The conference call will be available via webcast in real time over the Internet and you may join by linking at the internet site: Webcast Link

Group’s FY 2023 Financial Results per Operating Sector:

Parent company is included in Unallocated functions.

FY 2023 Financial Statements of Quest Holdings will be posted on Athens Stock Exchange website (www.helex.gr) and on Quest corporate website (www.Quest.gr) on Thursday 4th of April 2023.