At full year 2022 Quest Group recorded Sales of more than €1 billion.

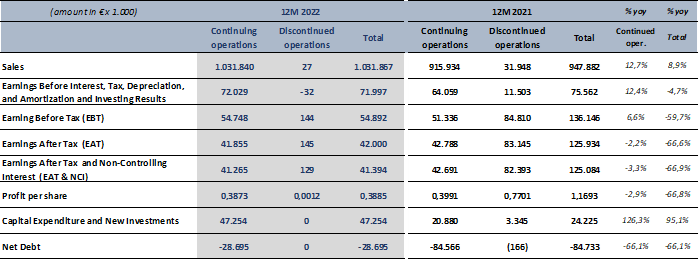

On a consolidated basis Sales were €1.032m, EBITDA €72m, EBT €55m and EAT €42m.

Continued Operations consolidated Sales (excluding Cardlink which was sold on 30/9/2021) grew by 12,7%, EBITDA by 12,4%, EBT by 6,6% while EAT marginally decreased by 2,2% compared to 2021.

Compared to last year (including Cardlink’s results) Quest Group Sales grew by 8,9%, while EBITDA decreased by 4,7%. EAT appears decreased by 67% mainly due to last year’s extraordinary non-recurring capital gains of €78,1m mainly from the sale of the participation in Cardlink.

The main consolidated financial results & figures are illustrated as follows and are broken down to “continued” and “discontinued” operations (corresponding to Cardlink S.A. and Cardlink One S.A., according to IFRS):

* Do not include “other gain/losses” related to investment activity.

Group’s Net Cash (Cash and Cash Equivalents - Debt) was €28,7m, compared to €84,5m at 31/12/2021. The change is mainly due to the distribution of dividends summing up to €61m, and new investments. The Group’s main investments during 2022 were related to the development of the new central hub for postal services, to the energy sector and G.E. Dimitriou. It should be noted that during 2022 the Group’s profitability was burdened by a €2,8m one off allowance to the lower paid personnel of the group.

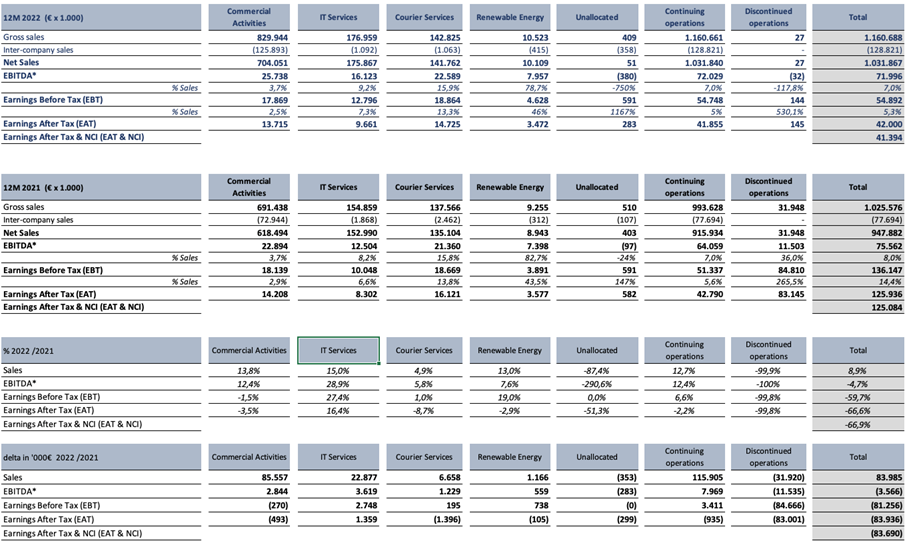

12M 2022 Results per segment:

Ø Commercial Activities (Info Quest, Quest on Line, iSquare, iStorm, Clima Quest, FoQus & GED as of 1/9/2022). Consolidated sales reached €704m, achieving a double-digit growth (+13,8% compared to 2021), followed by EBT of €17,9m, marginally decreased by -1,5% on a YoY basis, due to compression of margins in IT products and increased depreciations. The steepest growth comes from Apple products sales, while on the opposite side e-commerce sales were weaker, compared to last year’s (2021), during which there was no physical retail alternative for several months due to the lockdowns.

Ø IT Services (Uni Systems, Intelli Solutions, Team Candi).

Consolidated sales reached €176m. augmenting at a double-digit pace (+15% compared to 2021), while EBT grew by 27%, to €12,8m. Profit margins continued to improve, further assisted by the consolidation of “Intelli’s Solutions” earnings (with an EBT of about €1,5m). Demand for IT services continues to grow, due to the high number of digital transformation projects in the EU as well as the digital transformation program “Greece 2.0”. Projects backlog is currently north of €500m.

Ø Postal Services (ACS Courier).

Consolidated sales were €142m (+4,9%) and EBT €18,8m, marginally improved by +1% compared to 2021. The results are adversely affected by the fall of e-commerce in 2022, since last year’s parcel deliveries were boosted by lockdowns. Additionally, during 2022 there is also an impact by higher transportation costs related to fuel.

Ø Renewable Energy Production (Quest Energy).

Consolidated sales were €10,1m (+13%), and EBT were €4,6m (+ 19%) vs 2021, due to the new addition of 6,2MW PV parks. Total installed power reached 34,2MW by the end of 2022.

Ø Quest Holdings (parent company).

Parent company revenues reached €15,8m compared to €13,2m last year, including 2022 dividends of €14m compared to €11,4m during 2022. EBT were €13,4m compared to €150,4m in 2021, of which €87,2m were capital gains from the sale of the participations in Cardlink and TEKA, and €52,4m were reversals provisions for impairments of Uni Systems and Info Quest Technologies.

Quest Holdings BoD, during its meeting on 29/3/2023, decided to propose a dividend distribution to the upcoming Annual General Assembly of €0,20 (gross) per share. This is a distribution of a total of €21,5m profits. Quest Holdings AGM is scheduled for Thursday 15th June 2023.

2023 Outlook

In more detail, the following outlook is estimated per segment:

Commercial Activities: For 2023 we estimate growth in sales and a similar (or slightly higher) profitability compared to 2022. Growth is estimated to be driven mainly by the clima sector and international expansion, while a drop in margin of Apple (iSquare/iStorm) products is expected.

IT Services: A growth in sales and profitability is estimated, driven by a high demand for IT services in Greece and abroad.

Postal Services: We estimate growth in sales and profitability compared to 2022, driven by e-commerce expansion.

Renewable Energy Production: We estimate growth, as a result of, the planned additional new solar parks.

It is noted that in 2022 Q3 (end of August) Quest Holdings participated in the share capital increase of G. Dimitriou AEBE (GED), following the relevant restructuring agreement. Quest Holdings invested €5m, acquiring 99,08% of GED shares. GED results as of 1/9/2022 are consolidated in the Group’s financial statements. GED is the leading company in the clima sector in Greece (operating the brand TOYOTOMI). It will be Quest’s main vehicle in the clima market which seems very promising during the following years driven by the climate change.

On aggregate, we estimate a mild growth in sales and profitability for 2023 at a similar pace to 2022. In must also be noted that that the Group has a solid commercial and financial position to successfully address any further challenges that might arise, having more than €200m in cash and available credit lines.

Quest Group’s management will host a conference call to present and discuss the Full year 2022 Financial Results, on Thursday 6h of April 2023, at 15:30 Athens time.

· GR participants dial in: + 30 213 009 6000 or + 30 210 946 0800

· UK participants dial in: + 44 203 059 5872

· US Participants dial in: +1 516 447 5632

The conference call will be available via webcast in real time over the Internet and you may joinby linking at the internet site: Webcast Link

Group’s 2022 Financial Results per Operating Sector:

Parent company is included in Unallocated functions.

2022 Financial Statements of Quest Holdings will be posted on Athens Stock Exchange website (https://www.athexgroup.gr) and on Quest corporate website (www.Quest.gr) on Thursday 6th of April 2023.